Looking for a Business Loan?

Get Cash for Your Business As Fast As 7 days

BRDGE loans to businesses with funds of up to $2 million over a tenure of 12 months. Receive your approval within 7 days*.

*7 days from receiving all necessary documents required by BRDGE for credit assessment.

Grow Your Business and Boost Cash Flow

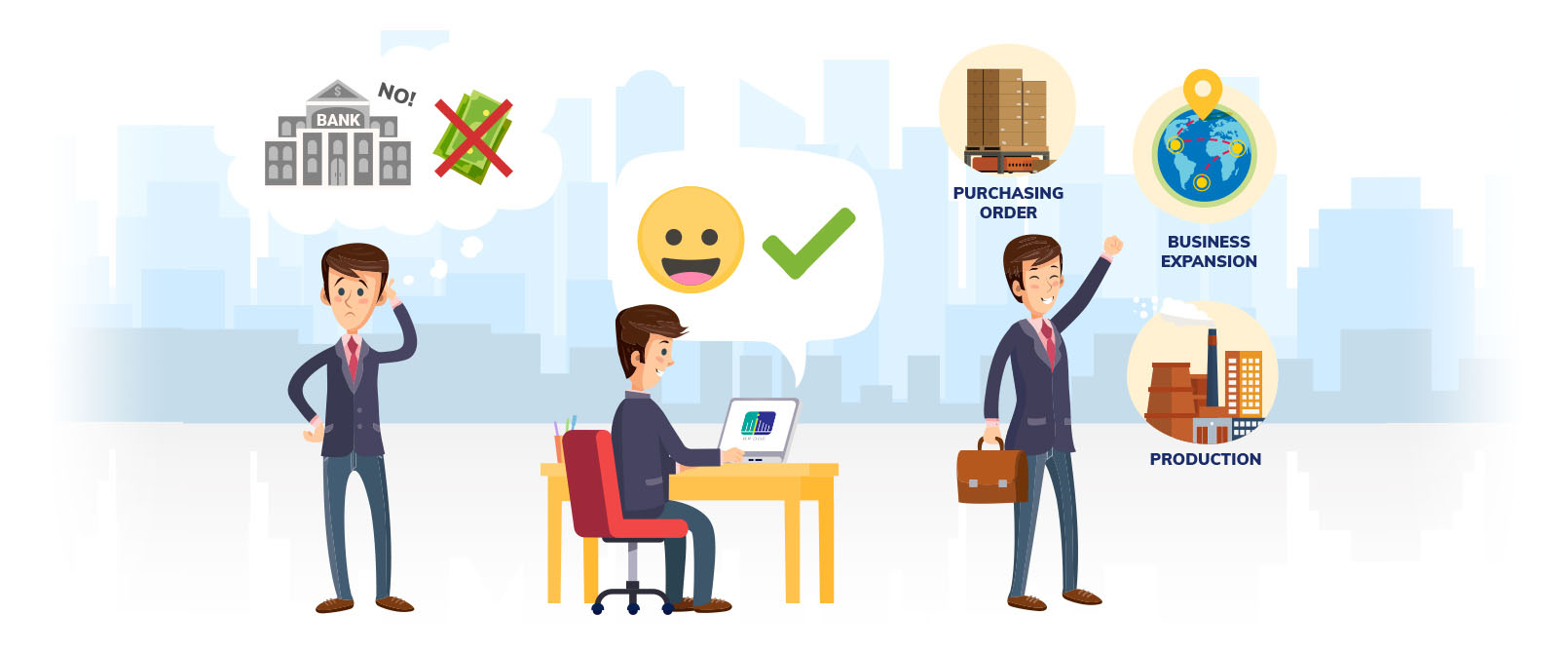

Too many local businesses are finding their business growth hampered by a lack of cash flow or a weak working capital position. On top of this, small to medium enterprises (SMEs) find it difficult to receive loans from banks due to multiple factors such as operational and credit history. This poses a risk to the business.

In instances like the above, SMEs can look to P2P crowdfunding platforms like BRDGE for working capital. BRDGE bridges SMEs with Matched Lenders, who lend their own cash through the platform. This crowdfunding process allows SMEs to access loans at lower interest rates, while investors earn returns at a higher than average market rate.

A much-needed injection of capital can help businesses grow and expand. BRDGE’s offer of flexible funding is an alternative way to finance your business.

YOUR BUSINESS IS GREAT - IT'S TIME TO SHOW THE WORLD HOW TRULY GREAT YOU CAN BE.

BRDGE's innovative approach to business financing involves combining technology with the art of crowdfunding. This offers SMEs an alternative to financing while offering Matched Lenders opportunities to diversify their portfolio.

Join the thousands of businesses who've received financing

-

Approval within 7 days

You can receive a decision and funding in as fast as 7 days*.

*7 days from receiving all necessary documents required by BRDGE for credit assessment. -

We say "yes" more than traditional financiers

We fund SMEs based on the growth prospects of your business - not just your financial history. -

100% focused on SME Growth

Unlike traditional financiers, you won’t be “just a loan” to us. We want you to “grow your business” with us. -

Customised Financing

There are no fixed packages. We hear your business needs and provide you with a customised loan package. -

Simple and transparent loans

Fixed interest rate. No hidden fees. No early repayment penalties. Completely transparent. We have the best alternative lender rates in the market. -

A brand you can trust

We have successfully funded over $80 million to hundreds of businesses in Singapore.

Financing Opportunity

You Can Trust

Here's a quick comparison if you're a fast-growing SME and is seeking funds at $300,000

| BRDGE | Traditional Financing | Funding from another alternative financier | |

|---|---|---|---|

| Repayment Term | Up to 18 months* | 12 to 60 months | Up to 12 months |

| Loan interest rate | 8% to 18% p.a. | Fixed Rate + Prime Lending Rate | 18%-60% p.a. |

| Early repayment penalty | No penalty. | Application fees + Facility Fees | Typically 3%-5% of quantum |

| Processing time | 7 days | 2 to 3 months | 7 days |

3-18 months tenure is dependant on final credit approval.

![]()

Typical Uses of

Business Financing

|

|

|

HOW IT WORKS

See if I qualifyComplete our simple online application form, which only takes a few minutes. Thereafter, we will contact you to discuss your business loan options and request for all necessary documentation that is required. |

Receive ApprovalWe will verify your eligibility and confirm facility amount for your business loan. |

Get FundsSign your documentation and funds will be transferred to your nominated account. Many of our customers are funded within 3 days of approval. |